When the cost of living rises, the impact is felt far beyond a bank account. The emotional weight of higher housing costs, increasing grocery bills, and unpredictable expenses often compounds stress that people are already carrying. Many individuals come to therapy feeling confused about why they are more anxious, more overwhelmed, or more reactive during financially pressured seasons. In reality, the mind and body respond directly to financial instability, and those responses are both normal and understandable. For individuals already managing anxiety, depression, trauma, or chronic stress, a tightening budget can magnify symptoms that might have felt manageable before. Dive deeper into this cycle with therapists from our Richmond, Virginia counseling center.

How Financial Pressure Disrupts Mental and Physical Wellbeing

Finances influence daily life in practical and emotional ways. When someone is consistently worried about money, the nervous system shifts into a heightened state of alert. The body begins releasing stress hormones, sleep becomes disrupted, concentration declines, and irritability increases. The brain becomes preoccupied with basic survival concerns, which makes planning, problem solving, or staying patient with loved ones far more difficult.According to Don Winkler, LCSW, “Financial stress may start with your perception of your personal finances and then travel throughout your entire body as your perceived worries related to your finances begin to increase while fearing no relief is in sight. Symptoms of the elevated distress may include difficulty sleeping, indigestion, difficulty concentrating, and perhaps a loss of energy.”

Financial strain also interacts with symptoms of mental health conditions. Someone experiencing anxiety might feel hypersensitive to every new expense. A person with depression may struggle with motivation, which makes financial tasks feel impossible. ADHD can make budgeting and planning much harder during stressful periods. These interactions can create a cycle in which emotional health influences financial decisions, and financial stress then feeds back into emotional symptoms.

The physical toll is significant as well. Chronic financial stress can lead to headaches, muscle tension, digestive issues, insomnia, high blood pressure, and weakened immune function. Often these physical symptoms appear long before a person recognizes the emotional load they have been carrying.

The Ripple Effects of Financial Pressure on Daily Life

As economic pressures increase, many people shift their routines or coping habits in ways that reflect emotional exhaustion. It may feel harder to open bills, schedule medical appointments, or plan meals. Some individuals turn to overeating, overspending, or substance use for temporary relief, even if these choices worsen stress in the long run. Others withdraw from social relationships because they feel embarrassed about their financial situation or simply too overwhelmed to connect.

Common stress shaped coping patterns include:

- Avoidance of financial tasks

- Relying on numbing strategies such as overeating or substance use

- Perfectionism and overworking as attempts to regain control

- Social withdrawal

- Conflict with partners or family members

Winkler acknowledges, “Like a temperature gauge in your automobile that alerts you when your engine is starting to overheat, your body alerts you of the need to explore healthy ways to reduce the elevated level of stress you may be experiencing. With support, you can gradually begin to reduce the perceived level of distress while seeing improvements in the areas of your life you were being challenged by.”

Relationships often feel the strain first. Money is one of the most common sources of conflict among couples and families. Even small financial decisions can start to feel emotionally charged when stress is high. Couples may argue more frequently, lose patience with one another, or experience a growing sense of emotional distance. Without support, these tensions can lead to decreased trust and increased feelings of isolation.

Financial strain also follows many people into the workplace. It may become harder to focus on tasks, stay motivated, or feel connected to coworkers. Fatigue and emotional overwhelm can increase mistakes or absenteeism. Over time, performance concerns can lead to additional financial anxiety, creating a cycle that becomes increasingly difficult to break without support.

Practical Steps, Protective Factors, and Professional Support for Financially Driven Stress

Although financial pressure can be intense, there are meaningful strategies that help people reclaim a sense of control and emotional steadiness. Financial literacy is a powerful protective factor. Basic tools such as budgeting, saving small amounts, or setting up automatic payments can reduce uncertainty and build confidence. When paired with emotional support, these tools help stabilize both mental health and finances.

People often find it helpful to approach money with mental health in mind. Supportive practices include:

- Setting realistic and achievable financial goals

- Using simplified budgeting systems rather than overly complex tools

- Working with a financial counselor when needed

- Creating routines that limit decision fatigue

- Breaking difficult tasks into smaller steps

Access to support services makes a significant difference. Counseling provides a stable space to untangle stress, explore beliefs about money, and learn skills for emotional regulation and problem solving. Community programs, financial coaching, and support groups can offer additional encouragement and resources. When these supports are combined, clients often feel more hopeful and more capable of making meaningful change. Don emphasizes, “Struggling to manage your budget is not a reflection of your worth. It is a challenge that many people experience during various times of their lives when unexpected expenses may arise. It is important to remember that you never need to navigate through very difficult times alone due to many available sources of support. When you pause and take a deep breath, you become more receptive to exploring the possible resources to help you move forward along your journey of financial recovery.”

There is no shame in struggling with financial stress. Changes in the economy have affected individuals and families across all income levels. Seeking help is an act of strength, not a sign of failure. A plan for stability begins with clarity, compassion, and collaboration. Tracking expenses, identifying priorities, and setting small goals can create structure in a time that feels chaotic. Partnering with a therapist, financial advisor, or trusted support person can lighten the emotional load.

Moving Toward Stability and Support

If rising costs have affected your emotional wellbeing, you are not alone. Addressing mental health and financial stress together provides a stronger foundation for long term health. Everyone deserves to feel supported, grounded, and valued, no matter their financial situation.

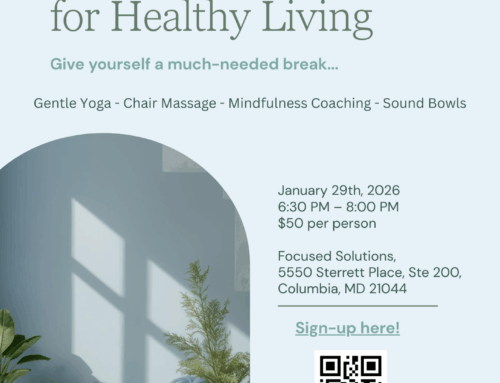

At Focused Solutions, we provide compassionate and evidence-based counseling Richmond, Virginia, for individuals, couples, and families. Our clinicians offer compassionate and evidence based counseling for people navigating emotional stress, financial strain, chronic anxiety, trauma responses, or the pressure of an unpredictable economy. We believe that healing becomes possible when people have both the emotional tools and the practical support needed to move forward with confidence and clarity.

You do not have to navigate this season without help. With the right support, stability and hope are well within reach.